Deep-Tech Startups Support Program (DTSU), Deep-Tech Startups Support Program in the Green Transformation field (GX)

Program overview

- DTSU: Program period: FY2023 to FY2032, budget: JPY 93billion (total amount of program period)

- GX: Program period: FY2024 to FY2032,FY2025 budget: JPY about 30 billion

-

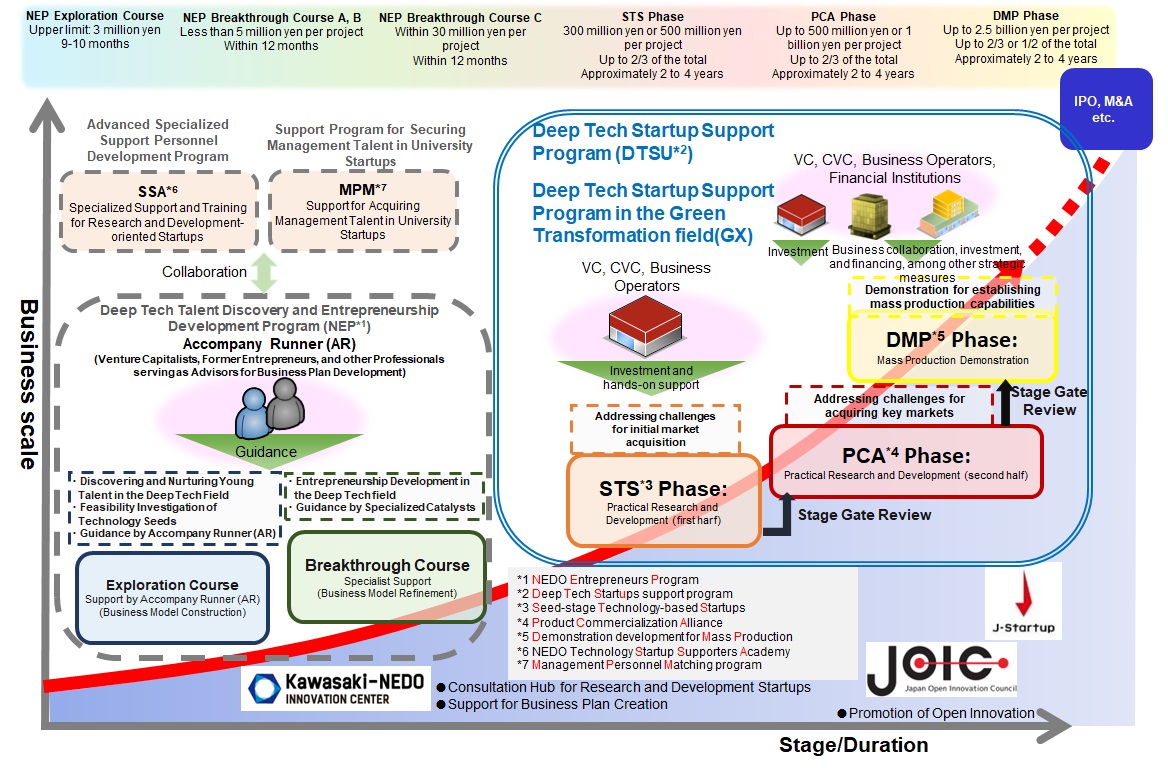

Overall picture of startups support programs in the deep-tech field

Overall picture of startups support programs in the deep-tech field

"Deep-Tech Startups Support Program (DTSU)" and "Deep-Tech Startups Support Program in the Green Transformation field (GX)" provide support for research and development and commercialization in three phases for "deep-tech startups" engaged in research and development of innovative technologies. Eligible projects are those that require long-term research and development and large-scale funding to establish the technology, commercialize it, and implement it in society and that are considered to contribute to solving economic and social issues (carbon neutrality, resource circulation, economic security, etc.) to be addressed by the country or the world as a whole, despite the high risk involved.

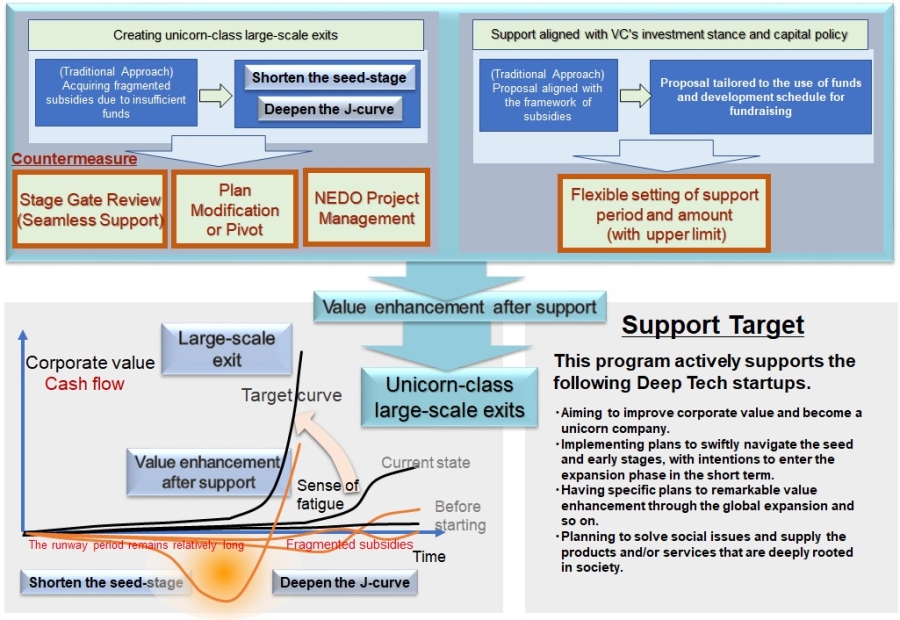

DTSU and GX : Aims and Measures

-

DTSU and GX : Aims and Measures

DTSU and GX : Aims and Measures

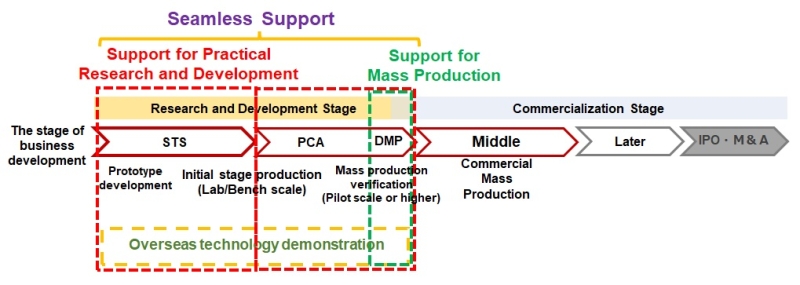

Details of Support

Program Flow, Program Period, NEDO's Contribution Rate, and Maximum subsidy Amount

-

Phases to be supported

Phases to be supported

| Phase | Maximum program period*(1) | NEDO's contribution rate | Maximum subsidy amount | ||

|---|---|---|---|---|---|

| (1) STS | Up to four years for each phase. | [Once-through support] Six years (One program period is the period until the next round of fundraising.) |

Within 2/3 of the subsidy-eligible expenses | 300 million yen or 500 million yen *(2) | Total Up to 3 billion yen |

| (2) PCA | 500 million yen or 1 billion yen *(2) | ||||

| (3) DMP | Within 2/3 of the subsidy-eligible expenses or 1/2 of the subsidy-eligible expenses *(3) | 2.5 billion yen | |||

- *(1): The program period is set based on the period from the time when the business receives investment from VCs, CVCs, or other operating companies when it applies for this support program until the next time when the business plans receives investment from VCs, CVCs, or other operating companies (new fundraising). Approximately 1.5 to two years are standard. The maximum period in the above table can be set by going through the Stage-Gate (SG) reviewing process.

- *(2): Conditions for subsidy increase: When the partner in the commercialization partnership is able to submit a statement of intent and a plan for overseas technology demonstrations

- *(3): Conditions for 1/2 contribution rate: When the ratio of the total amount of loans to the total amount of investments and loans in the DMP phase is 1/2 or more.(DTSU only. In GX, within 2/3.)

Each project can be continued in the same phase or the next phase if it is approved by the Stage-Gate review.

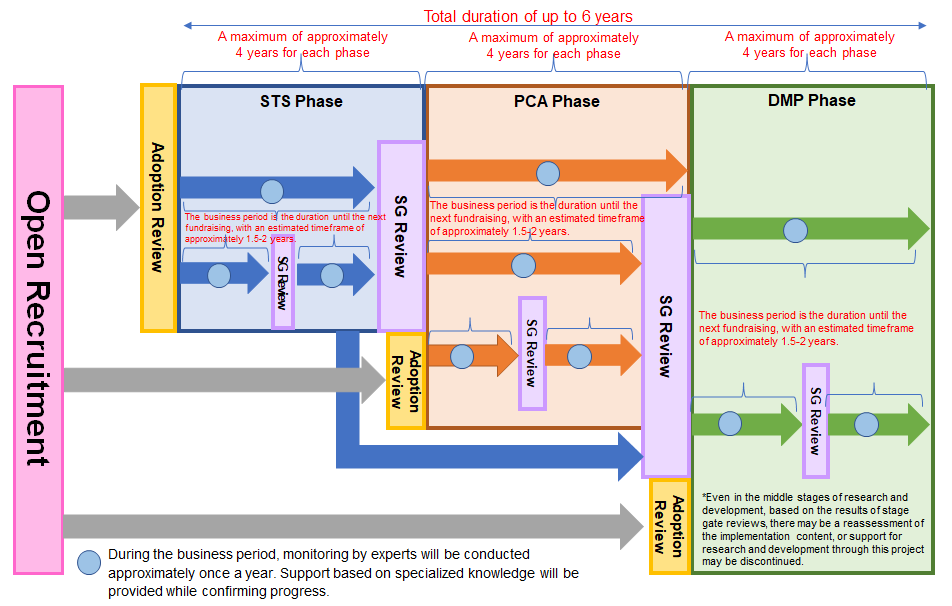

Timing of Application and Stage-Gate Scheme

Applications can be submitted from any phases. However, each proposer may apply for only one phase that best fits one’s company.

(To apply for a phase, the applicant is required to judge the suitability of the phase based on the most advanced business or research and development activities in one’s company).

Public recruitment will be open for five years, from FY2023 to FY2027.

-

Timing of Application and Stage-Gate Scheme

Timing of Application and Stage-Gate Scheme

The support for each phase of the program is as follows.

| Phase | STS phase | PCA phase | DMP phase |

|---|---|---|---|

| Target |

|

|

|

| Support |

|

|

|

| Subsidy rate | 2/3 or less | 2/3 or less | 2/3 or less or 1/2 or less *(3) |

| Subsidy amount | 300 million yen or 500 million yen *(1) | 500 million yen or 1 billion yen *(1) | 2.5 billion yen |

| Major requirements (for details, refer to the open call guidelines) |

|

|

|

- *(1): The maximum amount can be increased when the partner in the commercialization partnership is able to submit a letter of intent and a plan for overseas technological demonstrations.

- *(2): Investments include convertible securities (convertible equity, convertible bonds, convertible notes, etc.)

- *(3): If the ratio of the total loan amount to the total investment and loan amount required to apply for the program is 1/2 or more, the subsidy rate will be reduced to 1/2 or less. (DTSU only. In GX, within 2/3.)

- *(4): A period separately determined by NEDO based on the period from three months before the proposal deadline to one month after the date of the decision to adopt.

Adopted projects

| Company Name | Research theme | Fiscal year of adoption | Phase | |

|---|---|---|---|---|

| A | Aeterlink Corp. | R&D Cost of develops and provides "WPT" (wireless power transfer) technologies and solutions in Japan and overseas. | 2024 | PCA |

| AgroDesign Studios | Accelerate creation of novel agrochemicals using molecularly targeted agrochemical platforms | 2023 | STS | |

| AI Medical Service Inc. | Development of global products for upper gastrointestinal endoscopic AI | 2025 | PCA | |

| AISing Ltd. | Research and development of production efficiency-enhancing edge AI solutions for the manufacturing industry | 2024 | PCA | |

| AMI Inc. | Social Implementation of the Heart Sound AI Diagnostic Assistance System and Development of Heart Sound Biomarkers | 2023 | PCA | |

| AMI Inc. | Development of Novel Phonocardiographic Digital Biomarkers and Establishment and Validation of Business Foundations in Key Markets | 2025 | PCA | |

| Anaut Inc. | Global deployment of surgical AI technology through optimization with next generation clinical devices | 2024 | PCA | |

| Anaut Inc. | Integration of surgical support AI technology with next-generation medical devices and global expansion | 2023 | PCA | |

| ARCS Inc. | Development of automation systems for assisted reproductive technologies | 2023 | STS | |

| A-SEEDS Co., Ltd. | Development of Mass-Production Technology for the Clinical Implementation of Innovative CAR-T Cell Therapy | 2023 | PCA | |

| A-SEEDS Co., Ltd. | Development of Mass-Production Technology for the Clinical Implementation of Innovative CAR-T Cell Therapy | 2025 | PCA | |

| ASTER Co., Ltd. | Demonstration of mass production for social implementation of the ASTERMOTOR drive system | 2023 | DMP | |

| Atonarp, Inc. | Advanced mass spectrometry sensors for real-time, automated control in semiconductor fabs | 2025 | PCA | |

| AWL, Inc. | Development of Fundamental Technology associated with Scalable AI Solutions for On-Site Productivity Improvement | 2023 | PCA | |

| B | BiPSEE Inc. | Development of VR Digital Therapeutics for Depression | 2023 | STS |

| bitBiome, Inc. | Technological Enhancements and Business Validation Toward International Development of Microbial Gene Database | 2023 | PCA | |

| BlueWX Company Limited | Development of turbulence/wind prediction system through deep learning | 2025 | STS | |

| Boston Medical Sciences, Inc. | Development of a non-invasive colorectal cancer screening system based on deep learning | 2023 | STS | |

| Boston Medical Sciences, Inc. | Development of a non-invasive colorectal cancer screening system based on deep learning | 2025 | PCA | |

| C | CaTe Inc. | Development of exercise workload optimization function and cardiac rehabilitation program medical device | 2023 | STS |

| Celaid Therapeutics Inc. | R&D Cost of HSC Expansion Platform Technology for Cell and Gene Therapy Companies | 2023 | STS | |

| CellFiber Co., Ltd. | GMP manufacturing of cells with CellFiberTM Technology | 2023 | PCA | |

| Cosomil, Inc. | Globalization of Single Enzyme Activity-based Liquid Biopsy | 2023 | STS | |

| Crafton Biotechnology Inc. | Development of a drug discovery system based on fully chemically synthesized mRNA | 2025 | STS | |

| CrowdChem, Inc. | Development of a materials platform for integrating internal and external data in the materials industry | 2025 | STS | |

| D | DigitalArchi Co., Ltd. | Development of a resource-recycling 3D printed construction method that revolutionizes productivity | 2025 | STS |

| digzyme Inc. | in silico enzyme libray development | 2023 | STS | |

| E | Eco-Pork co., ltd. | Technological improvement and commercialization verification for international expansion of pig image recognition technology | 2024 | PCA |

| EF Polymer K.K. | Demonstration for the multi-site development and large-scale utilization of fully organic superabsorbent polymers | 2025 | PCA | |

| ElevationSpace Inc. | Development of High-Frequency Space Experimentation and Recovery Platform. | 2023 | STS | |

| EX-Fusion Inc. | Realization of high-precision, high-speed machining of difficult-to-process materials by high-power laser processing machines | 2023 | STS | |

| EXORPHIA,Inc. | Development of EV-Containing Medium that Significantly Increases the Success Rate of In Vitro Fertilization | 2024 | STS | |

| F | Fermelanta, Inc. | Microbial production of useful compounds by multistep gene introduction system | 2023 | STS |

| Fermelanta, Inc. | Applied Research on Microbial Fermentative Production of Valuable Compounds through Multi-Step Metabolic Pathways | 2025 | PCA | |

| FLOSFIA INC. | Demonstration of low-cost mass production of high-performance α-Ga2O3 power semiconductors | 2024 | DMP | |

| FOX Co., Ltd. | Development of innovative low-cost, high-quality mass production technique for gallium oxide substrates | 2024 | STS | |

| F.MED Co., Ltd. | Development of a microsurgery assistance robot and a training system. | 2024 | STS | |

| FuturedMe Inc. | Construction of drug development platform of disease-specific degradation by CANDDY | 2023 | STS | |

| G | Galdieria, Co., Ltd. | Launching a resource recycling business applying microalgae to precious metal recycling adsorbents. | 2023 | PCA |

| GramEye Inc. | Commercialization development of Gram staining automated AI medical device and overseas demonstration project | 2023 | PCA | |

| H | Horizon Illumination Lab Optics, Co. Ltd. | Technology Development for the Fundamental Innovation and Clinical Deployment of Opto-Diagnostics | 2025 | STS |

| I | illuminus.inc | Establishment of a continuous synthesis system to accelerate practical application of complete solid solution | 2025 | STS |

| Instalimb, Inc. | Development of a microfactory using AI specialized in prosthetics and orthotics | 2023 | PCA | |

| Integral Geometry Science, Inc. | Research for mass-production of in-line battery inspection equipment of current density distribution | 2023 | DMP | |

| J | JiMED Inc. | Development and commercialization of a wireless implantable BMI | 2024 | STS |

| Japan Superconductivity Application Development Inc. | Development of Manufacturing Technology for Ultra-Fine Intermetallic Compounds Superconducting Wire with High Flexibility and Low AC Losses | 2025 | STS | |

| K | KAICO Ltd. | Research and development of base manufacturing towards commercialization of oral vaccine/feed additives for swine | 2023 | PCA |

| KAICO Ltd. | Demonstration development for mass production of oral vaccine/feed additive for swine | 2025 | DMP | |

| L | LEBO ROBOTICS INC | Automation of Wind Turbine Blade repair robot | 2023 | PCA |

| Letara Ltd. | Development of a small hybrid thruster for a small spacecraft | 2023 | STS | |

| Letara Ltd. | Space demonstration of hybrid chemical propulsion using plastic as fuel | 2025 | PCA | |

| LexxPluss, Inc. | Development of autonomous heavy transport robots for mixed-flow production in a human coexistence environment. | 2023 | DMP | |

| LinqMed Inc. | Development of the drug discovery platform based on 64Cu to expedite the R&D of new-generation drugs | 2023 | PCA | |

| LiSTie Inc. | Development of a high-purity lithium extraction technology from solid material | 2025 | STS | |

| Logomix | Commercialization of synthetic biology platform | 2023 | STS | |

| LOMBY Inc. | R&D Cost for the Development of an Autonomous Driving Robot for Fully Automating Short-Distance Transport of Goods and People | 2024 | PCA | |

| LQUOM, Inc. | Development of long-distance quantum communication system and market creation | 2023 | STS | |

| Luxonus Inc. | Development of flexible-arm photoacoustic imaging system | 2023 | PCA | |

| M | Mantra Inc | Developing foundational technologies for Manga Machine Translation | 2025 | STS |

| MaRI Co., Ltd. | Innovative medical device based on contactless bioinformation measurement using mmwave radar | 2023 | PCA | |

| Medionnect, GK | Development of Next-Generation Artificial Knee Joint and AI Surgical Assistance for Innovative Treatment | 2025 | STS | |

| Metroweather Co.,Ltd. | Development of small, low-cost Doppler LiDARs and accuracy verification methods for mass production. | 2023 | PCA | |

| MiCAN Technologies, Inc. | Development of MylcMAT products using immortalized monocytic cells aMylc | 2023 | PCA | |

| MiCAN Technologies, Inc. | Development of MylcEndo products for the LAL market using immortalized monocytic cells aMylc-Z | 2025 | PCA | |

| MJOLNIR SPACEWORKS Inc. | Development of mass-produced hybrid rocket system | 2023 | STS | |

| Morus Inc. | Creation of a Japanese materials industry through mass production and overseas expansion of silkworm biomaterials | 2023 | STS | |

| N | N.B.Medical Inc. | Development of an Innovative Anti-Thrombotic Coated Stent for Intracranial Aneurysm Treatment | 2023 | STS |

| Nanofiber Quantum Technologies, Inc. | Development of quantum repeater utilizing cavity QED | 2023 | STS | |

| Nature Architects, Inc. | Development of innovative EV component design environment utilizing metamaterials | 2023 | PCA | |

| Nippon Fiber Corporation | Research and development of production technology for recycled coal ash fiber | 2023 | PCA | |

| O | Oishii Farm K.K. | Development of plant factory technology and validation of business model to realize sustainable agriculture | 2023 | DMP |

| P | Pale Blue Inc | Establishment of mass production technology for a propulsion system using water as a propellant for artificial satellites. | 2023 | DMP |

| PROVIGATE, Inc. | Development of a Behavior Modification System Using Minimally/Non-Invasive Weekly Average Blood Glucose Monitoring for Home Use | 2024 | DMP | |

| Q | Quadlytics.Inc. | International Expansion of Wearable Epileptic Seizure Detection Systems | 2023 | STS |

| R | Rapyuta Robotics Company Limited | Development to expand the introduction of picking and storage solutions into warehouses | 2023 | DMP |

| Red Arrow Therapeutics, K.K. | Development of pH-sensitive polymers as an inovative platform for protein delivery | 2024 | STS | |

| Regional Fish Institute, Ltd. | Development of high-quality aquatic product species adapted to global boiling conditions | 2025 | DMP | |

| RENATUS ROBOTICS K.K. | R&D of a large-scale automated warehouse system utilizing optimized fleet control for resolving the logistics crisis | 2024 | STS | |

| RICOS Co. Ltd. | AI-based Thermal-Fluid Simulation Leading to Automated Product Design | 2023 | STS | |

| RIVERFIELD Inc. | Project to develop a domestic surgical robot with pneumatic-driven force sensing function for the U.S. market | 2025 | PCA | |

| S | SAKANA Dream Inc. | Creation of Delicious Next-Generation Aquaculture Fish Adapted to Global Warming | 2023 | STS |

| Sonire Therapeutics Inc. | Research and development for practical application of next-generation focused ultrasound therapy system for refractory cancer | 2023 | PCA | |

| Spectronix Corporation | Development of Mass Production Technology for Short-Wavelength Picosecond Laser Oscillators | 2025 | PCA | |

| Splink, Inc. | Development of a Versatile AI Neuroimaging Technology to Optimize Dementia Diagnosis | 2024 | PCA | |

| T | T.G.Medical Inc. | Commercialization of a device for the treatment of acute ischemic stroke due to atherosclerosis. | 2023 | STS |

| TeraWatt Technology K.K. | Mass production verification of ultra-high energy and ultra-high power density lithium-ion batteries | 2023 | DMP | |

| ThinkCyte K.K. | Demonstration of mass production of an AI-based high-throughput cell analysis and sorting system | 2023 | DMP | |

| Thinker Inc. | R&D of “Self-learning robot hand” | 2024 | STS | |

| TIER IV, Inc. | Development of software-embedded electrification modules for autonomous driving | 2023 | DMP | |

| TKG Therapeutics, Inc. | R&D of a new immersive solid-phase synthesis method | 2023 | STS | |

| TriOrb Inc. | Realization of Variable-Volume and Variable-Type Production through Flexible Fabrication Using AMR | 2024 | STS | |

| Turing inc. | Development of an AI Foundation Model for Achieving Fully Autonomous Driving | 2024 | STS | |

| U | ugo, inc. | Development of an inspection AI robot to solve social infrastructure maintenance issues | 2025 | STS |

| United Immunity Co., Ltd. | Development of drug delivery capsule that selectively delivers mRNA et al. to immune cells | 2023 | STS | |

| W | WOTA CORP. | Development of a mass production-ready "Small-scale, decentralised water recycling system for residential use" | 2023 | DMP |

| X | xFOREST Therapeutics Co., Ltd. | Development of Hit to Lead Platform to Accelerate RNA-Targeted Small Molecule Drug Discovery | 2024 | PCA |

| # | 3D Architech, Inc. | Development of micro-architected gas diffusion layer for electrolysis with high output and low cost | 2023 | STS |

| Company Name | Research theme | Fiscal year of adoption | Phase | |

|---|---|---|---|---|

| E | Elephantech Inc. | Mass Production Demonstration of Equipment and Materials for Multilayer Printed Circuit Boards (PCBs) Using Nano Copper Inkjet Printing | 2025 | DMP |

| F | Friend Microbe Inc. | Development of a Microbial Wastewater Treatment System for High-Capacity, Oil-Containing Effluents Contributing to Decarbonization | 2025 | STS |

| FullDepth Co., Ltd. | Development to expand the introduction of picking and storage solutions into warehouses | 2024 | PCA | |

| G | Green ChemicaI Inc. | Demonstration project for industrial production technology of non-edible biomass-derived resin | 2024 | STS |

| K | Kyoto Fusioneering Ltd. | Development of high-power, continuously operating millimeter-wave generator and its application to deep geothermal heat, etc. | 2024 | STS |

| M | Material Gate Co., Ltd. | Development of practical Single Molecule Electret (SME) memory for low-power computers | 2024 | STS |

| N | NABLA Mobility, Inc. | Development of an operational network optimisation system to decarbonise aviation | 2024 | STS |

| O | OOYOO Ltd. | Development and Demonstration of a Compact and High-Efficiency Carbon Dioxide Capture System Using Membranes | 2024 | PCA |

| P | Planet Savers, Inc. | R&D of high-efficiency atmospheric CO2 enrichment system for practical use of DACCU | 2024 | STS |

| T | TopoLogic Inc. | Topological AFRAM Development | 2025 | STS |

| U | UMITRON K. K. | R&D Cost of Decarbonization-Promoting Product Development and Scaled Production in the Aquaculture Industry | 2024 | PCA |

| # | 3DC Inc. | Development of Functional Conducting Additive Using Innovative Carbon Material GMS | 2024 | STS |

| 3DC Inc. | Development of Functional Conducting Additive Using Innovative Carbon Material GMS | 2025 | PCA |

Adoption status

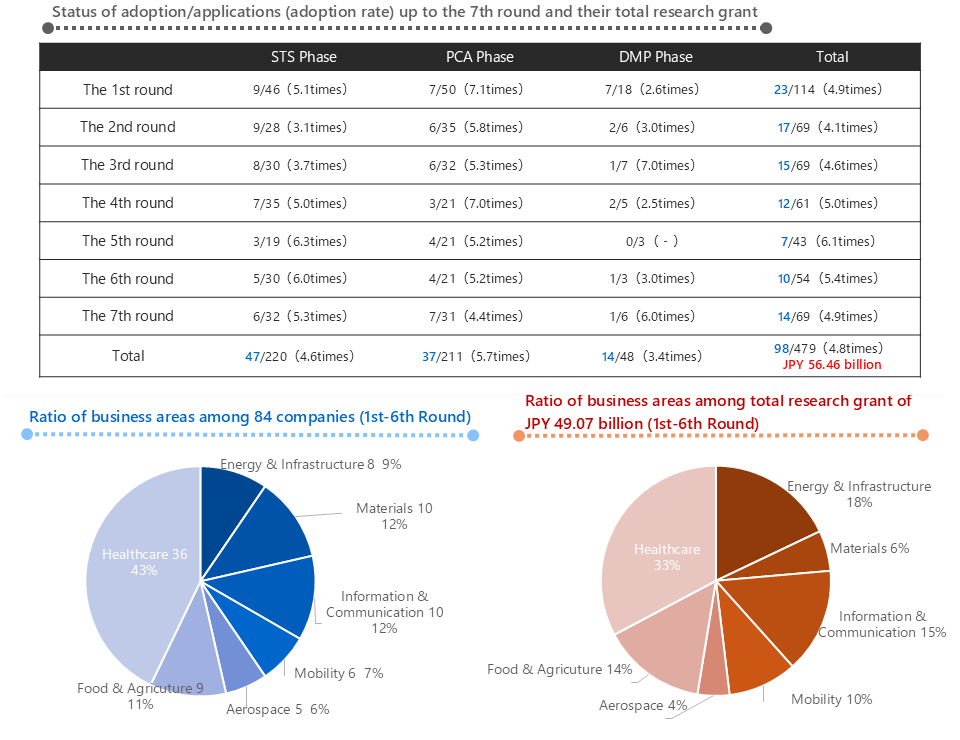

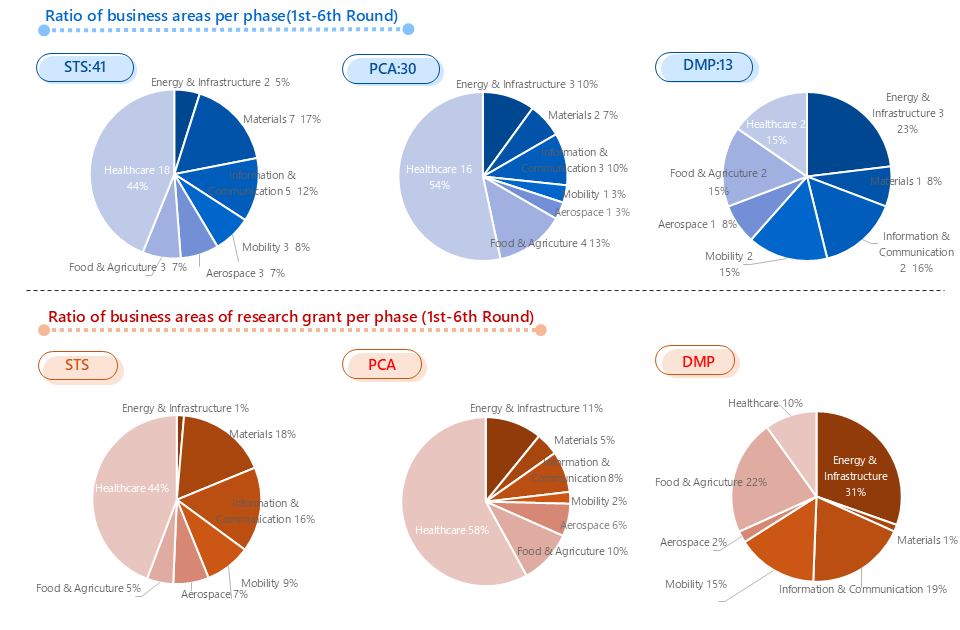

Adoption Status of DTSU(1st-7th Round) 【98 companies (STS:47 PCA:37 DMP:14)】

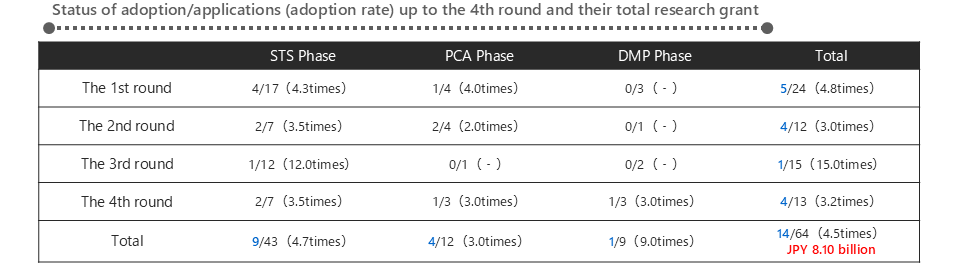

Adoption Status of GX(1st-4th Round) 【14 companies (STS:9 PCA:4 DMP:1)】

Basic information

| Technical field | Cross-sectoral proposal-based programs |

|---|---|

| Project code | P23019|P24011 |

| Department in charge | Startup Support Department (E-MAIL: dtsu@nedo.go.jp ) |

Last Updated : November 14, 2025